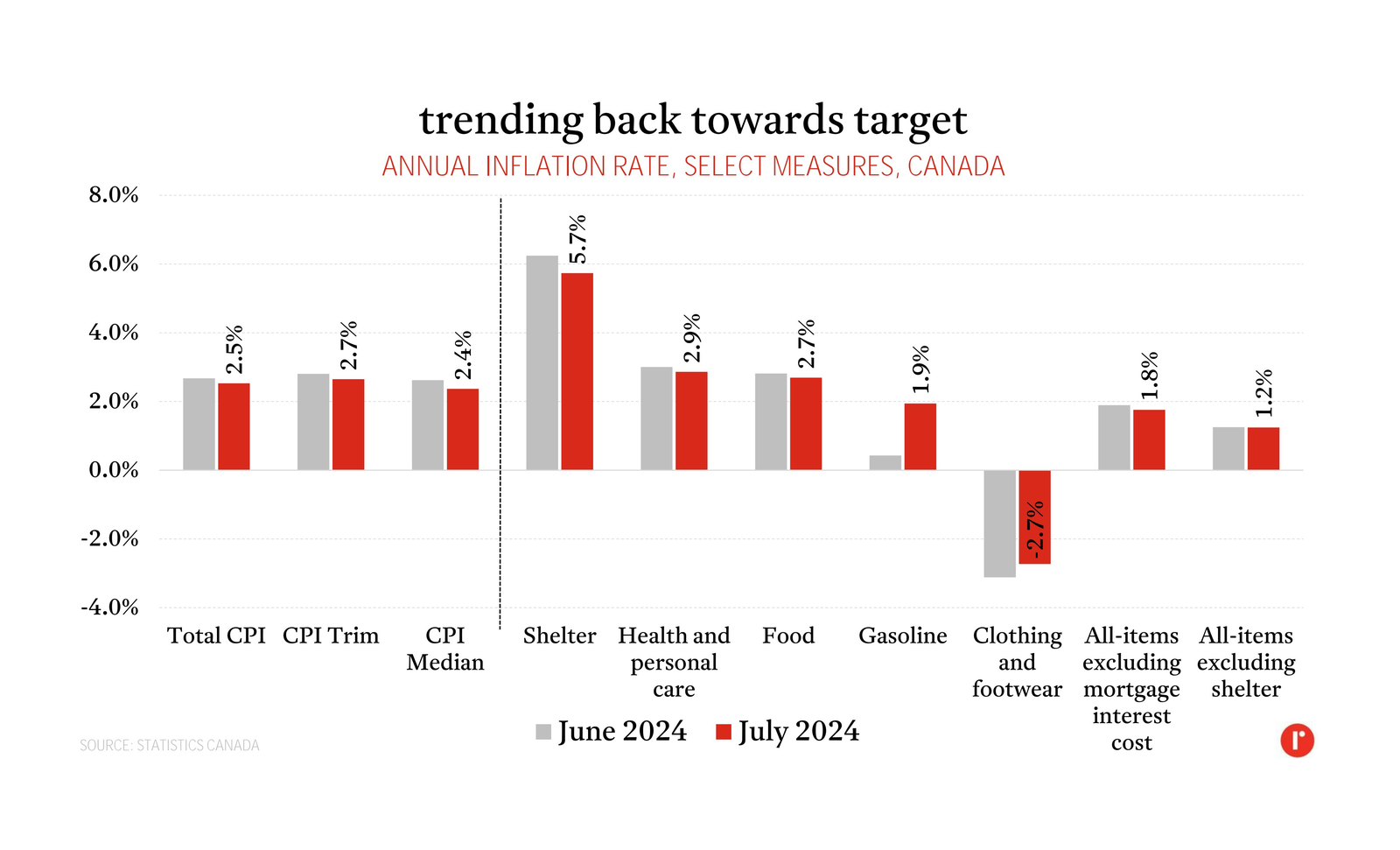

The latest release of Consumer Price Index (CPI) data from Statistics Canada saw a continuation of recent disinflationary trends. The overall rate of inflation declined again in July, to 2.5%, which is the seventh consecutive month inside the Bank of Canada’s target range of 1-3%.

Beyond the headline rate, there is plenty of evidence that suggests further easing of price pressures throughout the CPI which should give the Bank of Canada the confidence to lower its policy rate a further 25-basis-points to 4.25% on September 4th. Core measures of inflation (which strip out the most volatile elements of the CPI) all declined in July including the Bank’s preferred measure of CPI Trim (to 2.7%) and CPI Median (to 2.2%). Additionally, most of the major categories saw a decrease in their annual rate of inflation including household operations (to 2.7%), health and personal care (to 2.9%), and alcohol, tobacco, and cannabis (to 2.7%) which are all now below 3%.

Gasoline prices—which are notoriously volatile—did accelerate last month, however, their annual rate of increase was still just 1.9%. Even shelter, the one major outlier in its contribution to inflation saw a notable month-to-month decline to 5.7%.

At its last rate announcement the Bank noted that “Ongoing excess supply is lowering inflationary pressures. At the same time, price pressures in some important parts of the economy—notably shelter and some other services—are holding inflation up. Governing Council is carefully assessing these opposing forces on inflation.” The July CPI data show that the excess supply forces are outweighing those that are holding inflation up and reinforce the need for further cuts to the policy rate. Expect another cut on September 4th, and more at subsequent announcements.