With today’s release of another month’s worth of new retail sales data from Statistics Canada, we have the opportunity to evaluate the spending patterns of Canadians in June as they continue to navigate today’s high prices and restrictive interest rate environment. Before we get started, it’s worth noting even though we already know what happened with inflation in June (and July for that matter), the story told by retail sales data is important to the Bank of Canada (and to all of us who are trying to better understand the current economic plot), as the data shed additional light on the demand side of the economy as they assess the effects of their monetary policy decisions.

The overarching narrative is that there has been waning demand for retail products—everything from essentials like tomatoes and trousers to discretionary spending like tuxedos and concert tickets—as seasonally-adjusted retail spending declined nationally in June by 0.3%, to $65.7 billion. This continues a recent trend of declining retail sales, with monthly spending down 1.8% through the first six months of 2024.

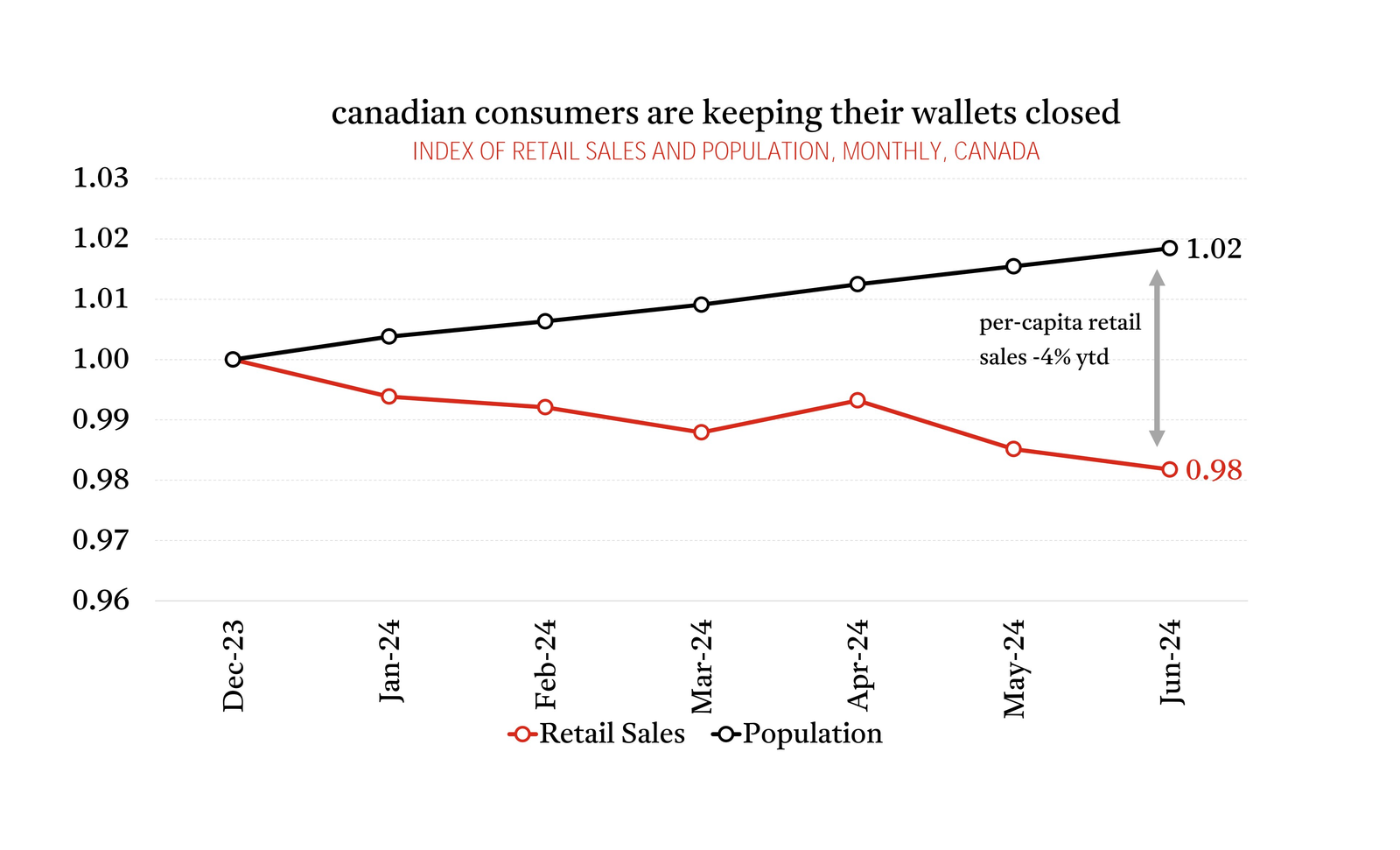

What’s more (and as we’ve noted before), Canada has continued to see outsized population growth so far this year, with the country’s working-age population increasing by 1.8% through the first half of the year (per the Statistics Canada Labour Force Survey). This means that retail spending on a population-adjusted basis has fallen even further than it appeared at first blush: by 3.6% year-to-date, to be precise. In fact, per-capita retail spending in June was at its lowest level since December 2021.

June’s retail spending figures represent yet another set of evidence that today’s monetary policy is too restrictive. Individual consumers are spending less at stores (and online) than at any point in the last two-and-a-half years, with prices that are substantially higher. Between the state of retail sales, inflation that’s both declining and been inside the Bank’s target range in every month this year, and a soft labour market that’s weakening each month, it’s clear that further reductions to the Bank’s policy rate are needed. The next one’s coming on September 4th—mark your calendars—with more to follow in the months ahead.